Our Thoughts on the Current Market - June 16, 2022

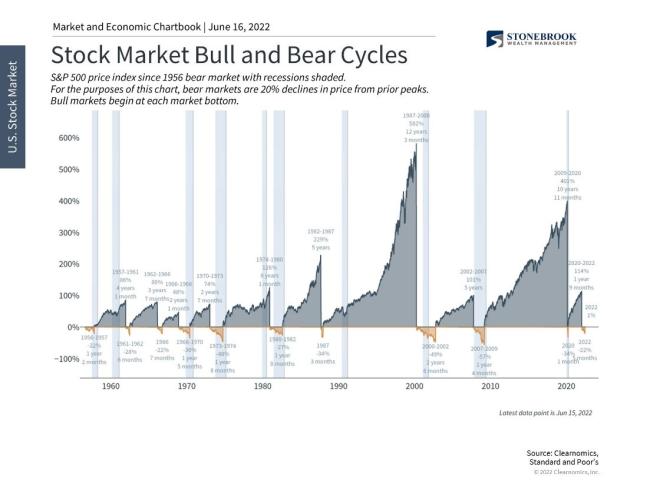

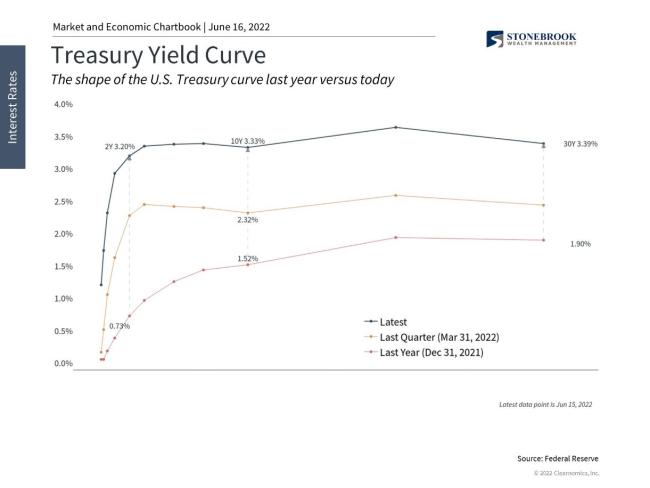

The S&P 500 officially fell to bear market levels this week. Rapid inflation across the economy has affected consumers and businesses, raising questions about spending and corporate profits. These pressures have pushed interest rates higher across the curve, breaking a four-decade pattern of falling yields. This has prompted the Fed to tighten more quickly and raise interest rates by 75 basis points for the first time in almost 30 years. Altogether, these events have led investors to swiftly re-evaluate asset prices across financial markets, resulting in steep declines this year.

Markets have fallen into bear market territory

For all investors, this is a challenging period that can be financially and emotionally stressful. In times like these, it's important to remember that staying patient and disciplined in times of market volatility is one of the core principles of investing. This is because markets fluctuate on a regular basis in response to a variety of market, economic and geopolitical factors. Having the knowledge and experience to separate important changes in long-term trends from short-term reactions can help investors to be positioned for future opportunities.

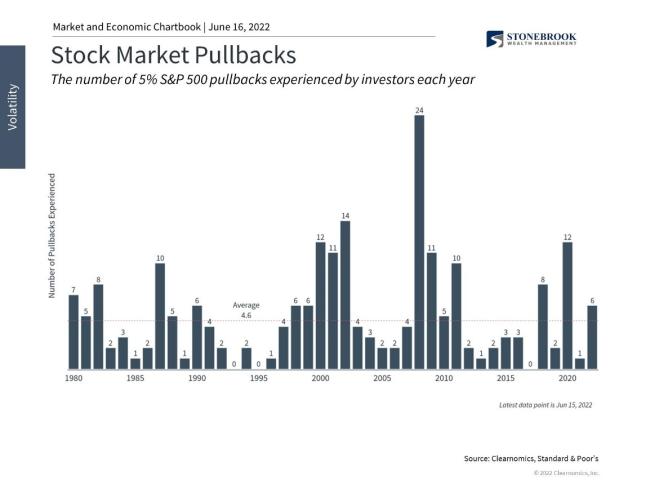

Stock market pullbacks and bear markets are normal

Unfortunately, it is human nature to be drawn to assets with prices that are rising and avoid ones that are falling. This is true even when this has little impact on what a stock may do next. The irony is that when stocks are the most attractively valued, investors want them the least. Recent price movements should have little bearing on what an asset is truly worth, so learning to overcome this bias takes training, experience, and often the guidance of a trusted advisor. After all, many investors wish they had been more disciplined after the market began to recover in mid-2020.

Interest rates have climbed steeply after falling for 40 years

Markets have been well ahead of the Fed which has, by their own admission, been behind the curve in responding to higher prices across the economy. It's not difficult to argue that markets are pricing in the worst-case scenario of a Fed-induced recession in order to ease these price pressures. If this is the case, any unexpected slowing of inflation, e.g. if energy or food prices decline, would be viewed as positive for markets. This is especially true because the economy is, by many other measures, still strong.

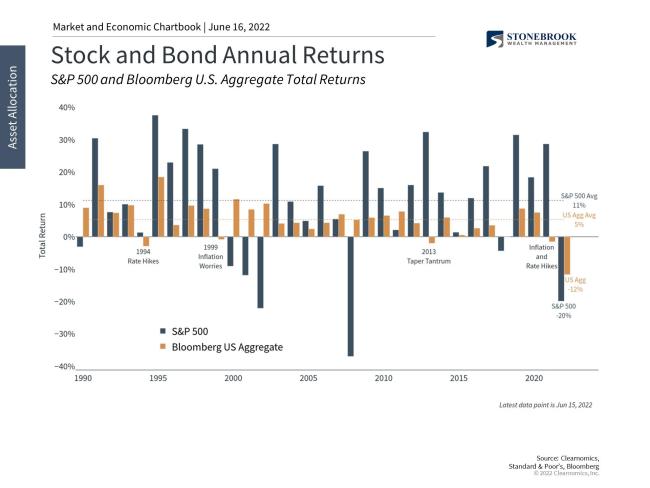

Perhaps what makes this bear market especially difficult is that nearly all asset classes have been impacted. It is unusual for stocks and bonds to be down at the same time, but this is in many ways a reversal of the "everything rally" of the previous two years, and arguably since the global financial crisis.

This is also because inflation has pushed interest rates higher which hurts bonds

exactly when many investors needed them the most. Falling bond prices have occurred across several episodes over the past 30 years, during other periods of rising rates and inflation concerns, only to recover soon thereafter. While this time may be different if interest rates remain elevated, the silver lining is that generating portfolio income is easier today than at any time over the past decade.

Both stocks and bonds have struggled this year due to rising interest rates

The bottom line? As markets find a level and the inflation story evolves, it's important for investors to maintain perspective. Market corrections and even bear markets are normal. Not only do markets historically recover, but this can happen when investors least expect it. Although the S&P 500 is 21% below its all-time high, it has experienced similar or fewer major pullbacks this year compared to 2020, 2018, 2009 (when the market was rapidly recovering), and throughout the early 2000s. While these were all difficult periods, the best course of action was to stay patient, hold a balanced portfolio, and avoid making emotional investment decisions. We are working very hard for our clients to navigate this volatility. Current data and past history both suggest that better months are ahead. If you have any questions or concerns, please feel free to call or email the office any time.

|

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |